According to research by Smithers in The Future of Packaging: Long-Term Strategic Forecast to 2028, between 2018 and 2028 the global packaging market is set to expand by almost 3% per annum, reaching over $1.2 trillion.

The global packaging market has increased by 6.8% from 2013 to 2018. Most of this growth has come from less developed markets, as more consumers move to urban locations and subsequently adopting westernized lifestyles. This has boosted a demand for packaged goods, which worldwide has been accelerated by the e-commerce industry.

Many drivers are having a significant influence on the global packaging industry. The four key trends that will play out across the next decade:

Economic and demographic growth

General expansion in the global economy is expected to continue over the next decade, boosted by growth in emerging consumer markets. There is the prospect for short-term disruptions from the impact of Brexit, and any heightening of tariffs wars between the US and China. In general, however, incomes are expected to rise, increasing consumer income for spending on packaged goods.

The global population will expand and especially in key emerging markets, like China and India, the rate of urbanization will continue to grow. This translates into increasing consumer incomes for spending on consumer goods, as well as exposure to modern retail channels and the aspiration among a strengthening middle class to engage with global brands and shopping habits.

Rising life expectancy will lead to aging of the population – especially in key developed markets, like Japan – will increase demand for healthcare and pharmaceutical products. Simultaneously there is a need for easy opening solutions and packaging adapted to the needs of elders.

Another key phenomenon of 21st century living has been the rise in number of single-person households; this is pushing demand for goods packaged in smaller portion sizes; as well as more convenience like reasealability or microwavable packaging.

Sustainability

Concern over the environmental impact of products is an established phenomenon, but since 2017 there has been a revived interest in sustainability focused specifically on packaging. This is reflected in central government and municipal regulations, consumer attitudes and brand owner values communicated via packaging.

The EU has pioneered this area with its drive towards circular economy principles. There is a particular focus on plastic waste, and as a high-volume, single-use item plastic packaging has come under particular scrutiny. A number of strategies are advancing to address this, including substituting to alternative materials, investing in the development of bio-based plastics, designing packs to make them easier to process in recycling, and improving recycling and processing of plastic waste.

As sustainability has become a key motivator for consumers, brands are increasingly keen for packaging materials and designs that demonstrably show their commitment to the environment.

With up to 40% of food produced worldwide not eaten – minimizing food waste is another key goal for policy makers. It is an area where modern packaging technology can have a major impact. For example, modern flexible formats like high-barrier pouches and retort cooking add extra shelf-life to foods, and can be especially beneficial in less developed markets where a refrigerated retail infrastructure is missing. Much R&D is going into improving packaging barrier technology, including the integration of nano-engineered materials.

Minimizing food losses also supports the wider use of intelligent packaging to cut waste within distribution chains and reassure consumers and retailers on the safety of packaged foods.

Consumer trends

The global market for online retailing continues to grow rapidly, driven by penetration of the Internet and smartphones. Consumers are increasingly buying more goods online. This will continue to increase through to 2028 and will see an elevated demand for packaging solutions – especially corrugated board formats – that can safely ship goods through the more complex distribution channels.

More people are consuming products such as food, beverages, pharmaceuticals on-the-go. This is increasing demand for packaging solutions that are convenient and portable, with the flexible plastics sector one main beneficiary.

In line with the move to single-person living, more consumers – especially younger age groups – are inclined to go shopping for groceries more frequency, in smaller quantities. This has driven growth within the convenience store retailing, as well as boosting demand for more convenient, smaller size formats.

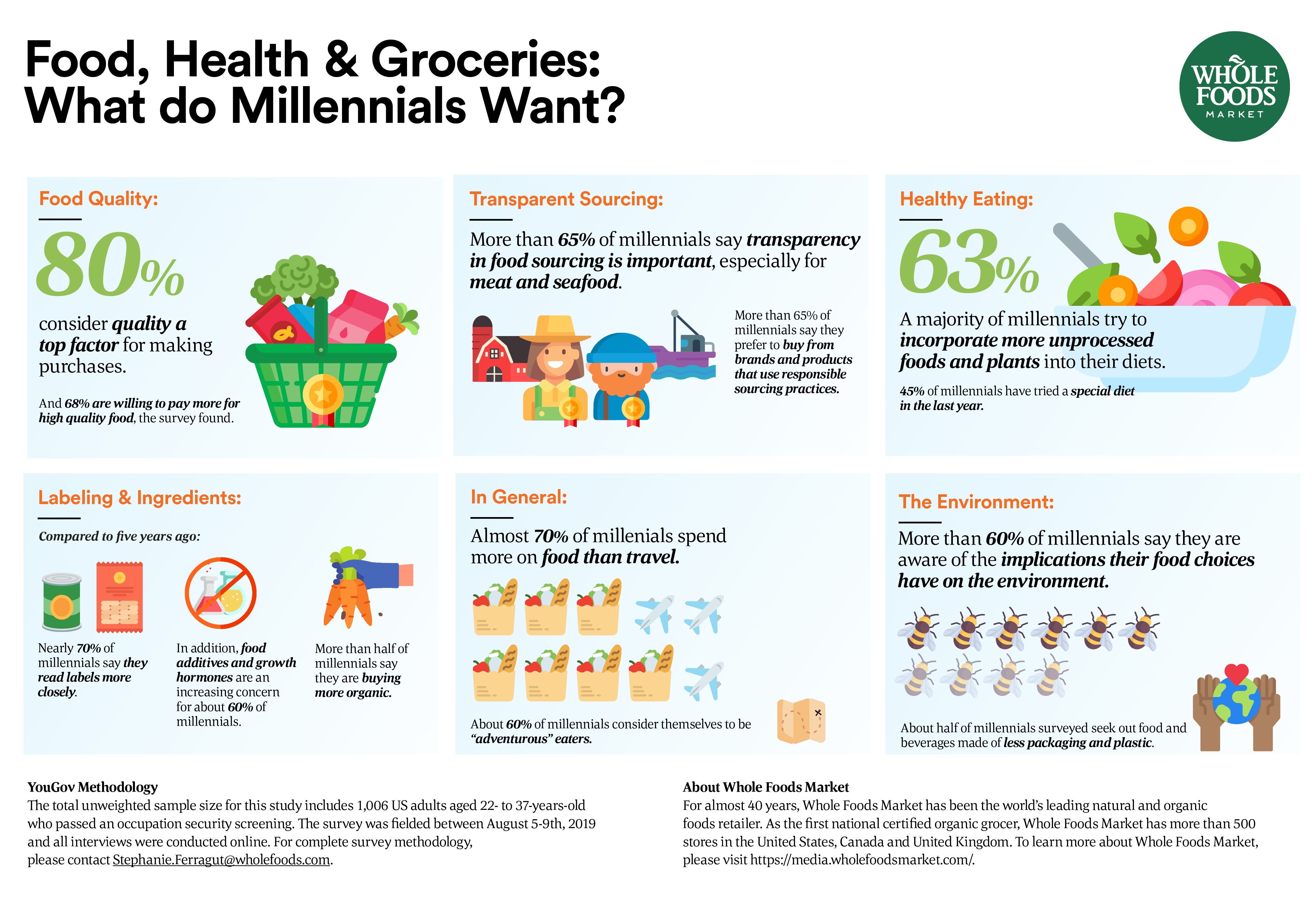

Consumers are taking a greater interest in their own health matters, leading to healthier lifestyles. Therefore, this is boosting demand for packaged goods, such as healthy foods and beverages (e.g. gluten-free, organic/natural, portion controlled) alongside non-prescription medicines and nutritional supplements.

Brand owner trends

The internationalization of many brands within the fast-moving consumer goods industry continues to rise, as companies seek out new high-growth sectors and markets. Increased exposure westernized lifestyles will accelerate this process in key growth economies through to 2028.

E-commerce and the globalization of international trade is also stimulating a demand among brand owners for components, like RFID labels and smart tags, to protect against counterfeit goods, and enable better monitoring of their distribution.

Industry consolidation in merger and acquisition activity in end-use sectors such as food, beverages, cosmetics, is also forecast to continue. As more brands come under the control of one owner, their packaging strategies are likely to become consolidated.

The 21st Century consumer is less brand loyal. This is simulating an interest in customised or versioned packaging and packaging solutions that can create an impact with them. Digital (inkjet and toner) printing is providing a key means to do this, with higher throughput printers dedicated for packaging substrates now seeing their first installations. This further aligns with the desire for integrated marketing, with packaging providing a gateway to link into social media.

—————————————————————————————————————————————

Source: www.smithers.com/resources/2019/feb/future-packaging-trends-2018-to-2028