60

SEP2017

FOOD FOCUS THAILAND

SPECIAL

REPORT

In 2016, The Thai fishery industry resumed growth for the first

time in four years, thanks toanumber of factors.Among themwere

Thailand’s upgraded status to Tier 2Watch List, fromTier 3, which

directly helped improve our image and confidence toward Thai

exports, inparticular,fisheryproducts (oneofThaiproducts thathave

beencloselymonitoredduespecifically tocertain labor issues).Other

factors included our success in tackling the shrimp EMS disease

outbreak, increased tuna supplies globally after leading countries in

marine fishery bolstered the size of their fishing fleets and because

of major Thai investments into countries with abundant fishery

resources.

In 2017, KResearch believes that Thailand’s fishery product

exports to the US - our largest fishery product export market - will

grow for thesecondyear, supportedbya recovery inour shrimpand

canned tunaexports,and the fact that labor issues in theThai fishery

industry have not worsened since 2016, given our status at Tier 2

WatchList. Since theTIPReport does not in itself involveany trade

intervention,anydirect impactonThai fisheryproductexportsshould

beminimal.AsmoreThai shrimp supplieswill enter themarket from

May to June, it is expected that Thai fishery product exports to the

US will have grown 3.0-5.0% to some USD 1.417-1.445 billion in

2017, whichwould bring our full-year fishery product export growth

to2.5-4.0% to aroundUSD 5.790-5.875 billion.

US IUUFishingRegulationsPresentaChallenge for

Thai Fishery IndustryAhead

Lookingahead,Thai fisheryproduct producersmaybepenalizedby

additional measures to be announced by the US to prevent Illegal,

Unreported and Unregulated (IUU) fishing, and seafood fraud, or

labeling that donot correctlycorrespondwith theproducts inside the

packaging,which isscheduled tobecomeeffective inJanuary2018.

Tocomplywith this regulation, importersofmarineproducts

1

sourced

from US and non-US territorial waters are required to adopt a

traceability program, which involves data collections on sourcing

throughout their supply chains.

Weat KResearchareof theview that our keyfisheryshipments,

for instanceshrimp,willbeexempted from the IUURegulation initially

because the USwants to help their own shrimp industry. But once

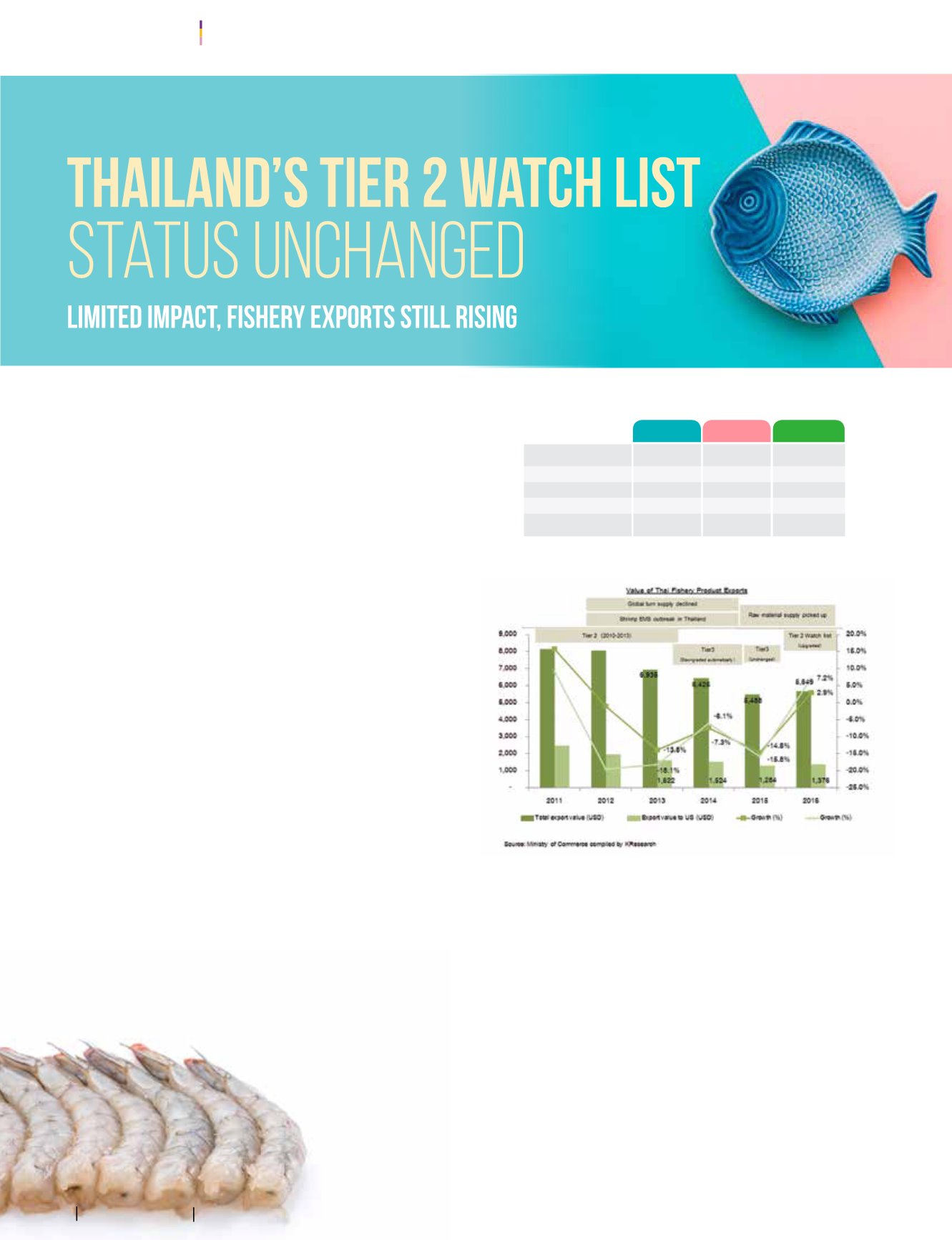

TIPReport2017

Table1

Valueof Thai FisheryProduct Exports (Unit: USDMillion)

Source:

Ministry of Commerce compiled byKResearch

2016

5M16

2017f

Export Value toUS

Growth (%YoY)

Share (%)

Total Export Value

Growth (%YoY)

1,376

7.2

24.4

5,649

2.9

483

1.6

21.9

2,206

4.8

1,417-1,445

3.0-5.0

24.4-24.6

5,790-5,875

2.5-4.0

USshrimp raiserscanadjust to the IUU regulation, it isexpected that

this regulation will be enforced on other fishery products, too.

Meanwhile, Thai tuna exports to the US should not be adversely

affectedmuchby this regulationbecausemajorThai tunacompanies

haveabusinesspresence in theUS.However, ithasbeen found that

severalsupermarkets in theUShave introducednew rulesonseafood

imports, including manufacturing standard certifications issued by

the relevant authorities of exporting nations on shrimp products.

Moreover, canned tunaprocessors inexportingnationsmust comply

with the traceability program standards if they want to sell their

products inUSWholeFoodsMarkets.

Therefore, the remaining time until then should be a good

opportunity for Thai operators to make advance preparations,

beginning with adopting a traceability program involving data

collectionsonsourcesand thesettingoffisherystandards throughout

their supplychains.ThiseffortwouldalsohelpThai fisheryoperators

to cope with EU IUURegulation - an issue that must bemonitored

closely ahead. The EU has extended an official warning or “yellow

card” toThailand since 2015.