32

APR2017

FOOD FOCUSTHAILAND

SCOOP

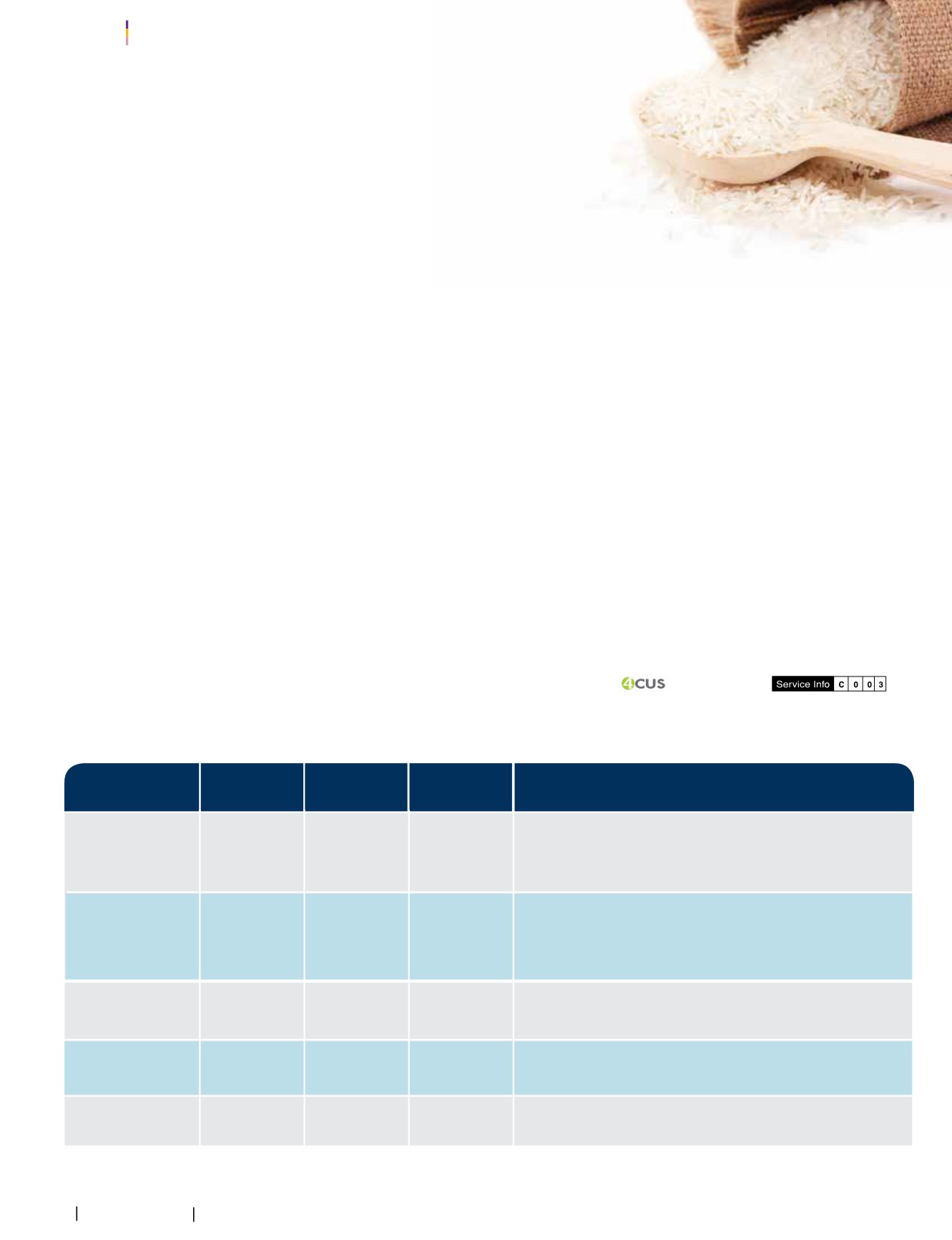

Remark:

* The food industry reported in this researchexcludes beverages

** Projected figures inUSD billion and figures in parentheses arepercentage changes from theprevious year

Source:

TheMinistry of Commerce, compiled andanalyzed byKResearch (As of January 19, 2017)

Product*

USA, Japan,

China

Japan

UK

Japan, USA,

China, Vietnam

Africa

China

•

Shrimp productionwill gradually recover after theEMS outbreak

has successfully been controlled.

•

Downside risks to the industry have eased gradually, e.g., IUUFishing

warning.

•

Flooding in southernThailand not exceedonemonth.

•

Chicken exports have abright outlook, especially processed chicken shipments

to Japan.

•

SouthKoreaallowsThailand toexport chilledand frozen chickenafter banning

fresh, chilled and frozen chicken imports fromThailand.

•

H5 avian flu outbreaks inmany chicken importing countries openexport

opportunities for Thailand.

•

Demand for canned pineapple from key trade partners, e.g., theU.S.

andNetherlands, remains strong.

•

Pineappleproduction is projected to increase after drought.

•

Abumper crop seen inmajor rice exporting countries.

•

Global demand for ricemay decline due to the sluggisheconomies of

major importing countries.

•

Prolongedeconomic slowdown inChina

•

China’s releaseof stockpiled corn as a substitute for tapioca is crimping demand

for Thai tapioca.

Processed fishery and

aquatic animals

• Shrimp

Processed livestock

andmeat

• Chicken

Fresh and processed

fruit and vegetable

Rice

Tapioca

5.5 (0.4)

1.82 (7.7)

3.0 (1.6)

2.5 (5.2)

2.3 (1.0)

4.1 (1.8)

2.9 (-15.8)

5.7 (3.0)

2.0 (11.0)

3.2 (4.5)

2.6 (5.0)

2.4 (2.0)

3.9 (-4.8)

2.8 (-1.4)

Export Value

2016**

Export Value

2017**

MajorMarket

Issues in2017

Table 1

Thai FoodExports in 2017

Due to the rosy outlook foreseen inThai chickenexports, it is expected that

the value of processed livestock andmeat shipments for 2017will increase 4.5

percent YoY toUSD3.2billion, ledby chickenwith theexport valueprojected to

increase 5 percent YoY to some USD 2.65 billion. However, Thai chicken

processors and exportersmust be vigilant towards avian diseases by avoiding

chicken breeds imported from Europe where bird flu outbreaks have been

confirmed in many countries. They should maintain high product quality and

standards, aswell.

Fruit and vegetable exportsexhibit steadygrowth,

ledby cannedpineappleand sweet corn

An important product in the fruit and vegetable category is canned pineapple.

AlthoughThai canned pineapple no longer enjoys theEUGSP privileges since

2001, it remainscompetitive relative to thoseof our rivals. In2017, it isexpected

thatourcannedpineappleexportswillgrowsubstantially, inbothvalueandvolume,

becausevolatility indomesticpineappleoutputdue todrought lastyearhaseased

and therewill likely be strong demand frommajor trade partners, e.g., theU.S.

andNetherlands.

Our canned sweet corn exports have also performedwell, thanks to strong

demand from key trade partners, e.g. Japan. Such exports are normally geared

towardsmediumand low income Japanese consumers, becausewehavea few

rivals. Thus, Thai cannedsweet cornshipmentsshouldcontinue togrow in2017

even if theEU renews its anti-dumping (AD) duty on this product this year.

As a result, KResearch is of the view that the overall fruit and vegetable

exports for 2017 will grow 2 percent YoY to USD 2.4 billion, driven by canned

pineapple and sweet corn shipments.

Rice exports are at risk amid sagging demand from

major tradepartners

In 2017, it is expected that there will be substantial rice supplies coming from

major rice exporting countries, especially Thailand and Vietnam, after their rice

outputswerehitbyseveredrought lastyear.Sinceglobal ricedemand isprojected

todeclinewitheconomicconditions inmajor importingnations, riceexport prices

will likely trend lower.However, highdomestic ricesuppliesshouldhelpoffset the

overall decline in riceexport valuesomewhat.KResarchhas forecasted thatThai

rice export in2017will stablewith the value of USD4.2billion.

Tapioca product exports remain a cause for

concernon the slowingChinese economy

China isamajor tapiocaexportmarket forThailand.However, itsanemic

economy and attempt to release stockpiled corn, being a substitute of

tapioca, haveweakeneddemand for Thai tapiocaproducts. Inaddition,

abumper cassava crop in2017will likelydepress tapiocaprices future.

Asa result, thevalueofThai tapiocaexportsmay fall 1.4percentYoY to

onlyUSD2.85 billion.

Policies of key trade partners warrant close

monitoringahead

Although Thailand’s food exports and food industry seem promising in

2017, businesses must monitor and adjust to changing environment

ahead. In particular, the food industry, which directly affects well-being

of consumers, will have to face tariff and non-tariff trade barriers.

Nevertheless,many leadingcompanies inThailandhavemadesignificant

adjustments to avoid those trade hurdles by investing in certain

businesses abroad. Even this may crimp the country’s export income,

their overseas investments will translate into higher national income.

Meanwhile, the growing popularity of Thai cuisine and proliferation of

Thai restaurantsabroadshouldsignificantlybolster theThai food industry

through increasingdemand for ingredients and seasonings ahead.

For Thai exporters who are still unable to invest abroad, notably

SMEs, they will need to maintain good product quality and standards,

e.g., through implementing the traceability system, seeking new export

markets, andaddingvalue to theirexport products.Theymust alsokeep

abreast of international trade policies of leading economies and trade

partners, inparticular theU.S. followingapresidential transition, aswell

as EU political issues, e.g., theBrexit and general elections scheduled

inmanyEU states.